The Property - Identifies the property being acquired.Manager - What entity or individual serves as manager of the company.Company Info - Describes the type of entity, number of membership classes, the amount of equity owned by each class.Company Objectives - The name of the company that investors are purchasing membership interests in, the intentions of this company, whether it is newly formed or existing, and whether or not it expects to generate and distribute cash flow.The Executive Summary provides a brief overview of the rest of the PPM content. This section also includes the sponsor’s contact information so that prospective investors know where to direct questions. It further explains that the securities being offered involve risks - in which investors must rely on their own examination of the company, its merits and risks of the investment. This section describes what exemption is being used ( 506(b) or 506(c)). This section also mentions the date on which the offering commenced, the date by which the minimum dollar amount must be raised, and the date by which the offering will close - if the maximum dollar amount is not raised. The name of the company for which membership units are being sold, the price of each unit, the minimum and maximum dollar amount that the company will raise. Let’s take a look at what a PPM contains. The rest of the offering documents are exhibits to the PPM. The PPM is the disclosure document that’s legally required by the Securities and Exchange Commission (SEC) for a private placement offering.

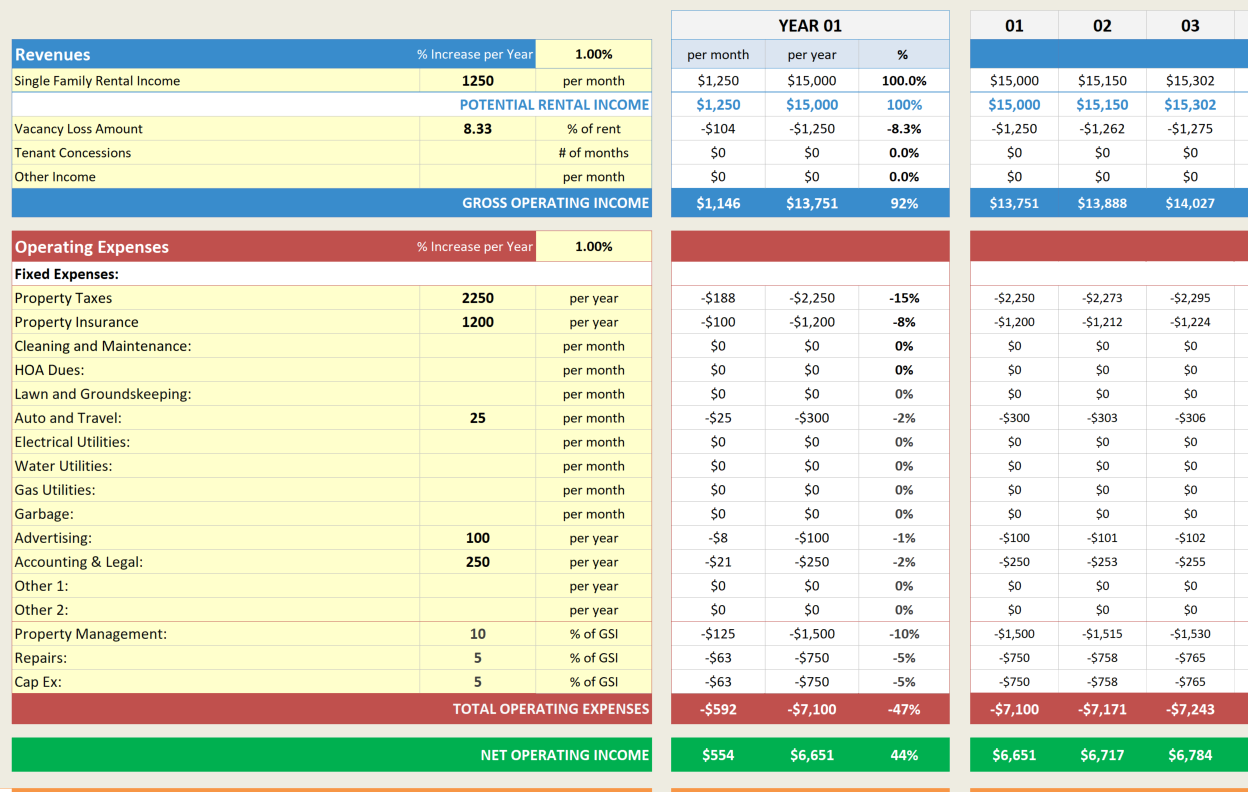

#Multi family cashflow spreadsheet full

It gives investors a full understanding of the securities being offered and the company’s objectives.

1) Private Placement Memorandum (PPM)Ī PPM essentially tells the “story” of the investment. In this article we’ll take an in-depth look at these three documents, and discuss the key items to look for in each. They are the: 1) Private Placement Memorandum 2) Operating Agreement and 3) Subscription Agreement. There are three major documents that you'll receive in the offering package of a multi-family syndication. This package will contain legal documents prepared by an SEC attorney that you must review and sign in order to invest.

#Multi family cashflow spreadsheet professional

In any legally structured syndication, prospective investors should expect to see a professional offering package.

0 kommentar(er)

0 kommentar(er)